As a small business owner, solopreneur, or freelancer, you wear many hats. You're the CEO, the marketer, the salesperson, and—perhaps most dauntingly—the accountant. Managing invoices, tracking expenses, and staying on top of cash flow can feel overwhelming, especially when expensive software like QuickBooks or Xero seems like overkill for your needs.

What if there was a powerful, intuitive, and completely free accounting software designed specifically for businesses like yours?

Enter Akaunting.

In this comprehensive guide, we’ll explore what Akaunting is, its key features, who it's for, and why it might be the perfect financial management solution to help your business thrive.

What is Akaunting? The Game-Changer in Free Accounting

Akaunting is a modern, web-based, open-source accounting software. Let's break down what that actually means for you:

Free and Open-Source: Unlike freemium models that restrict features, Akaunting is genuinely free. The core software has no hidden costs, user limits, or expiration dates. "Open-source" means its code is transparent and community-driven, leading to constant improvements and customization options.

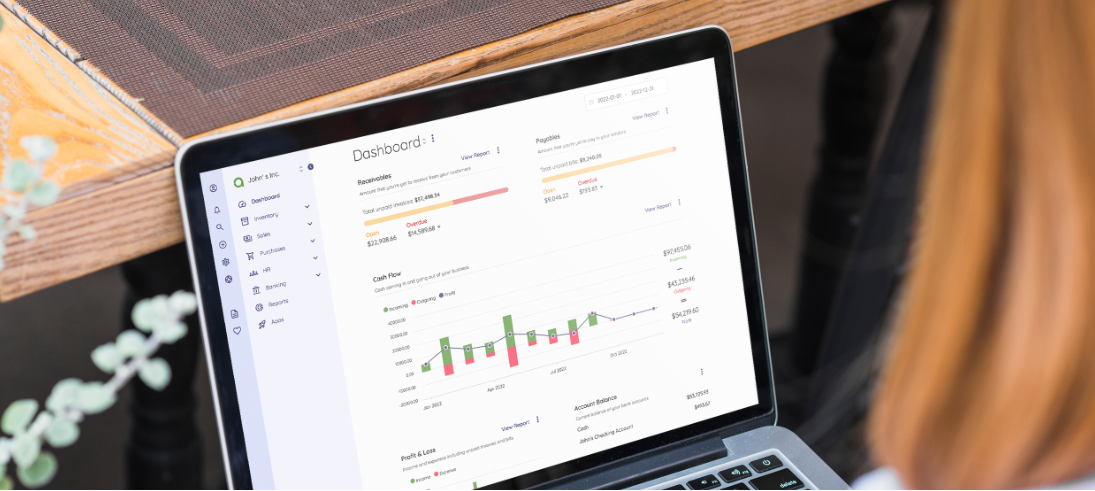

Web-Based (Cloud): Access your financial data from anywhere, on any device with an internet connection. No need for complex installations or updates—everything is handled seamlessly.

Designed for Simplicity: Akaunting boasts a clean, user-friendly interface that doesn't require an accounting degree to navigate. It’s built to make financial management intuitive, not intimidating.

Key Features That Make Akaunting a Powerhouse

Akaunting packs a serious punch with features that rival paid alternatives.

1. Invoicing Made Effortless

Create and send professional, customizable invoices in minutes. Set up recurring invoices for regular clients, accept online payments via gateways like Stripe, PayPal, and Razorpay, and automatically track payment statuses.

2. Expense Tracking & Bill Management

Snap a picture of a receipt or manually enter expenses to see exactly where your money is going. Record bills from vendors to keep track of what you owe, ensuring you never miss a payment.

(Image Suggestion: A screenshot of the Akaunting "Expenses" screen, showing a list of categorized expenses with amounts and dates.)

3. Comprehensive Banking & Cash Flow

Connect your bank accounts for automatic transaction feeds or manually record them. Reconcile your accounts with a few clicks to maintain accurate, up-to-date financial records and have a clear, real-time view of your cash flow.

4. Robust Reporting for Smart Decisions

Go beyond basic numbers. Generate detailed reports on Profit & Loss, Balance Sheets, Expense Summaries, and Income by Category. These insights are crucial for understanding your business's health and planning for growth.

5. Multi-Currency & Multi-Company Support

Do business globally? Akaunting supports over 170 currencies. If you run multiple businesses, you can manage them all from a single Akaunting installation, keeping finances perfectly separated.

6. Extensive Modules & Apps

While the core is free, Akaunting offers a marketplace of paid modules (apps) to extend functionality. Need inventory management, time tracking, or CRM integration? There's likely a module for that, allowing you to build a system tailored to your needs.

Who is Akaunting Perfect For?

Akaunting is an ideal solution for:

Freelancers & Consultants

Startups and Small Businesses

E-commerce Store Owners

Non-Profit Organizations

Agencies and Creative Studios

If you’re tired of spreadsheets and need a centralized, professional system for your finances without a hefty subscription fee, Akaunting is for you.

Getting Started with Akaunting is Easy (And Free!)

Ready to take control of your finances? Getting started is a straightforward process.

Sign Up for an Akaunting Cloud Account: The fastest way to get started is with their cloud-hosted version. It’s free forever for the core features, and you can be up and running in under 5 minutes.

Set Up Your Company: Enter your business name, contact details, currency, and tax details.

Customize Your Settings: Add your logo, customize invoice templates, and connect your payment gateways.

Start Managing Your Finances: Begin by creating your first invoice, adding your bank balance, and recording an expense.

Ready to Transform Your Business Finances?

Akaunting has the potential to be the financial backbone your small business needs. It eliminates the stress of money management, saves you valuable time, and provides the clarity you need to make informed decisions—all without draining your budget.

I highly recommend giving Akaunting a try. To support my blog and the content I create, you can use my referral link to sign up. It doesn’t cost you anything extra, but it helps me out!

👉 Start Using Akaunting For Free Now!

👉 Start Using Akaunting For Free Now!

Final Verdict

Akaunting stands out as a champion for small businesses in a world of expensive software. Its commitment to being free, open-source, and user-friendly makes it an unbeatable value. By combining essential accounting features with a modern, cloud-based approach, it empowers business owners to focus on what they do best—growing their business.

Have you tried Akaunting? Share your experiences in the comments below!